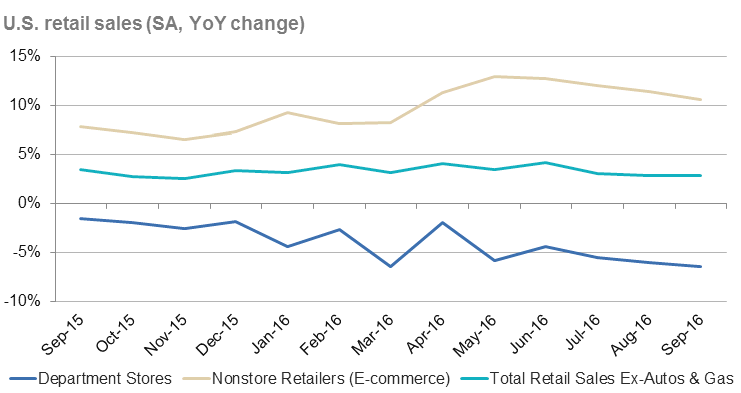

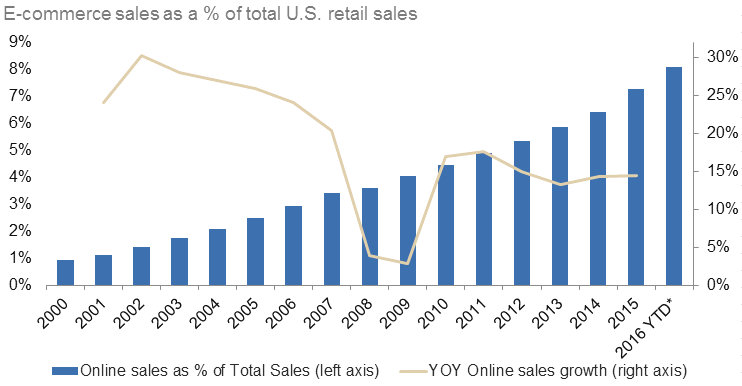

Macy’s shook the retail real estate world last August, announcing plans to close approximately 100 full-line stores in early 2017 as department store sales continued their secular drift on-line, away from apparel (electronics and experiences) and into other more nimble competitors (fast fashion). Macy’s revealed specific locations slated for closure this week following another disappointing holiday selling season and weakening outlook, with the fourth quarter result poised to be its ninth consecutive quarter of comparable sales decline. This unenviable track record follows a similarly consistent though positive prior years’ sales trend, with 2013 a particularly strong year which marked Macy’s fourth consecutive year of positive comparable sales growth…highlighting the difficulties larger retailers face adapting to a quickly shifting retail landscape, particularly given the persistent and meaningful rise in non-store (e-commerce) sales in recent years. For now, Macy’s plans to shutter 68 locations by mid-2017 and 30 more expected to wind down in the coming years as leases expire or locations are sold.

The impact to the mall REITs was expectedly benign, given ownership of higher quality and more productive locations and presumably deeper relationships between landlord and tenant, with only a dozen publicly-owned shopping centers on what appears to have been a dynamic closure list and the rest in private hands; REITs had been negotiating with Macy’s on potential closures since the announcement. The divergence within the REIT space was also unsurprising, with the “A-mall” REITs (Simon Property Group, General Growth Properties, Macerich and Taubman Centers) having only 1% of their mall base on the closure list (with Macerich and Taubman absent) while their “B-mall” REIT peers (CBL & Associates, Pennsylvania REIT and Washington Prime Group) will need to address vacant Macy’s spaces at nearly 6% of their malls in the coming months.

This recent batch of news (tepid holiday sales off-line and declining store counts) is not positive for mall owners, as inarguably indicated by the immediate and meaningful decline in share prices as well as the current historically large valuation discounts for the mall REITs. Yet the department store disappearing act has been ongoing for several decades – there were 56 different department store brands at the industry peak, compared to less than ten with national coverage remaining today following consolidation and closures since then. Notably, Sears Holdings has been steadily dwindling its department store count as its sales continue to spiral lower, as this once-relevant retailer seems destined to disappear or meaningfully downsize with a potential bankruptcy on the horizon; current 1-year credit default swap (CDS) spreads imply a nearly 50% probability of default. Sears announced it was closing an additional 150 stores following the Macy’s news this week, including 108 Kmart and 42 Sears stores. Only 12 of the 42 impending Sears closures are found in public REIT portfolios, which suggests the private mall owners will again bear the brunt of fading department stores.

Yet in the face of this ongoing and seemingly unrelenting department store deterioration, the mall REITs have delivered an average total return of more than 10% over the past decade, including during the consumer-led Great Financial Crisis of 2007-2008 when the mall sector lost two-thirds of its value. Notably, Simon Property’s total return during this 10-year period bested the REIT sector and broader equity market by more than 2.5x each, while trouncing B-mall brethren CBL’s total return by about 5.5x…which speaks to Simon’s (and other owners of A-malls) ability to recycle its portfolio, redevelop its properties and revamp its retail strategy to continue to attract shoppers, sales and ultimately retailers wanting to be at the best locations and willing to pay increasingly higher rents for the privilege. Notably, Simon’s 112 property portfolio at its 1993 IPO included only 53 malls that relied heavily on Penney, Sears, Dillard’s and Montgomery Wards, generated $218 sales per square foot and commanded rent of about $16.50 per square foot, compared to a 220+ property portfolio today (only 108 malls) with Macy’s as its top tenant with sales and average rent topping $600 and $50 per square foot, respectively…which coincided with an impressive, industry-leading total return for SPG shares.

Alas, the department store disappearing act is expected to continue, as consumer shopping preferences and distractions continue to move elsewhere. Most experts believe Macy’s 100-store closure is only the beginning, while Sears appears to be the next domino to fall with its still-mighty though free-falling $20+billion in annual sales unlikely to be fully dispersed among the remaining department store survivors. The path ahead for mall owners will clearly be challenged, as it always has been, particularly given the increasingly larger shadow cast by e-commerce. Yet the mall REITs with desirable portfolios and wherewithal to continue evolving in the constantly changing retailer landscape should operationally continue to fare better than owners facing outsized department store closures in the coming years, which should be reflected in better relative share price performance as well.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.