Last Friday, e-commerce juggernaut Amazon announced an agreement to acquire Whole Foods Market in an all-cash transaction valued at $13.7 billion. Whole Foods Market generated sales of nearly $16 billion in 2016 across more than 460 stores in the U.S., Canada and the U.K., which represents an estimated 2.5% share of the entire grocery industry. Share prices of competing grocers and retailers selling grocery items unsurprisingly fell on this news, given Amazon’s disruptive nature and willingness to forgo immediate risk-adjusted profits in its indomitable quest for growth and greater market share; the world’s largest grocery retailer Kroger was down 9.2%, which follows the prior day’s 18.9% decline on lower guidance. A bit more surprising was the negative market reaction by the retail REITs, a sector which already reflects one of the largest discounts to private market values, as the FTSE NAREIT Equity Shopping Centers index was down 3.9% on the day. While no one outside of Amazon knows the ultimate game plan for its Whole Foods purchase, perhaps not even Amazon itself, a few facts and thoughts are worth noting:

- Omni-Channel Goes Both Ways. Traditional retailers have been building their on-line presence for several years, to varying degrees of success and often at the expense of their physical stores. Pure e-commerce retailers, including Amazon, have conversely been opening physical stores, albeit at a slow and measured pace. While much of this “Omni-channel” growth has occurred within the apparel and non-perishable realms, Amazon’s acquisition of Whole Foods Market (including its leasehold interest across 460+ storefronts) validates the need for a physical location, closer to the consumer and in a higher income demographic in this instance.

- Grocery IS Internet-Resistant. “If you can’t beat them, BUY them”…or something to that effect. Amazon has reportedly been working on its grocery business since 1999 (including AmazonFresh which the company launched in August 2007), and yet food & beverage stores (primarily groceries and supermarket) have among the lowest e-commerce penetrations at 0.1% of total retail sales, based on recent U.S. Census Bureau data. This tepid growth is not entirely surprising as a recent Morgan Stanley survey concludes that U.S. consumers overwhelmingly prefer selecting “fresh products myself” (67% of respondents) and still “enjoy shopping in [grocery] stores” (33%) while also citing convenience (27%), with barriers to on-line entry including high shipping costs (26%), distrust of product quality (25%) and worries about damaged deliveries (19%). Amazon’s giant step into bricks-&-mortar grocery might suggest they have raised the white flag on making a dent in the under-penetrated grocery delivery business after a nearly two decades of work, or more likely that the company believes on-line needs off-line for meaningful growth in both platforms.

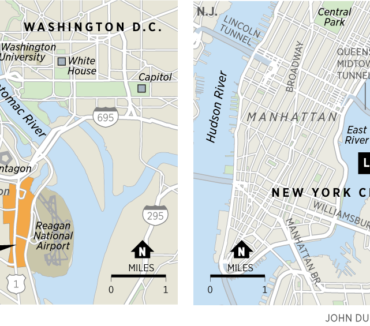

- Amazon Will Open More Stores. General Growth Properties’ CEO surreptitiously suggested Amazon’s goal was to open 300-400 bookstores on an earnings call last year. Media reports indicated Amazon’s desire is to open “more than 2,000 brick-and-mortar grocery stores” after it unveiled first AmazonGo prototype in late-2016, an estimate that was refuted by the company. It was also reported that Amazon explored the purchase of Whole Foods last year, but stepped away as it believed the grocer didn’t have the desired “scale” (translation: too small), while the grocer’s CEO recently commented that “over time, there could be other formats that evolve that wouldn’t be branded Whole Foods Market.” It is premature to peg with certainty what, where and how many Amazon stores will be up and running several years from now. Yet we believe the current 460+ Whole Foods locations do not reach the entire spectrum of Amazon’s intended customer base, particularly in light of recent news that Amazon is lowering the cost of Prime membership for customers on government assistance programs, which is unquestionably designed to lure in the lower income consumer. By comparison, it is estimated that 90% of Americans lives within 15 minutes of Walmart, which totals more than 5,300 U.S. stores. We believe 2,000 bricks-and-mortar Amazon grocery stores may end up being a conservative target.

- Grocery Prices & Margins Are Poised to Fall … at least at Whole Foods, aka “Whole Paycheck” as it charges a premium compared to the mainstream grocery retailers. This downsized pricing and margin expectation is derived from Amazon’s willingness to operate at a lower margin in its quest for growth; Amazon’s merchandise margin (excluding AWS) is roughly one-third of the typical 30+% retailer gross margin. The aforementioned negative market reactions suggest grocery prices overall are also poised to decline as Amazon is likely to compete on lower prices, even with ongoing food price deflation, which will pressure margins even more in an industry notorious for already slim profitability.

- …Presumably Governing Rent Growth. Yet the longer-term impact on the grocer’s rent-paying ability is unclear, and likely not as negative as the market reaction would suggest for the retail REITs. Whole Foods pays a premium rent despite being an anchor that draws traffic to even higher rent paying small shop tenants at most shopping centers, recently $24.12/sf for Whole Foods vs. $15.23/sf portfolio average and $26.42/sf for shop tenants for Kimco Realty and $20.74/sf vs. $20.26/sf and $31.31/sf, respectively, for Regency Centers. By comparison, the mainstream grocers pay rents in the $8-15/sf range, which still leaves room for profitability. Amazon has similarly shown a willingness to pay a fair-to-premium market rent as it has grown its industrial presence, which bodes well for owners of high quality shopping centers when Amazon ends up opening more high-rent paying Whole Foods Markets over time.

- High Quality Retail Centers Will Thrive. The retail REIT’s “Ready, Fire, Aim” share price reaction to the Amazon/Whole Foods news was puzzling, particularly for landlords that have the highest quality shopping centers and deepest relationship with Whole Foods. Whole Foods primarily leases its stores…notably, Amazon is acquiring Whole Foods’ lease liability and not the actual ownership of the real estate, along with the operating business, a key point we believe the market is missing and mispricing in the retail REITs. Operating covenants within these leases will prevent mass store closures, if this were Amazon’s intent. Rather, we believe Whole Foods will seek to expand with trusted partners at similarly attractive locations, possibly modifying permitted use clauses to operate as a quasi-distribution/retail center at select stores which could reduce shopping center vacancies even more.

- While Amazon has experimented in the grocery category since 1999 and has disrupted the apparel/mall sector, the oversupply of retail real estate will become more pronounced and put many privately-owned properties at risk. The countless stories of store closures is more a function of less desirable locations operated by smaller and less sophisticated passive owners, not professionally managed companies. Well-located shopping centers with high occupancy will thrive in this Amazon/Whole Foods growth scenario, as they have a proven ability to draw shoppers and desired tenants, which draws even more shoppers and desired (often different and higher-rent paying) tenants over time. Retail REITs will prove to be resilient as retailers come and go, and their high quality real estate endures.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.