The efficient-market hypothesis (EMH) is a long-debated economic theory first introduced in nascent terms in the early 1900s, and advanced starting in the 1950s, which essentially suggests “security prices fully reflect all available information.” Although variations exist, the natural conclusion is that stock price movements are unpredictable; therefore “you cannot beat the market” and active portfolio management is a futile endeavor.

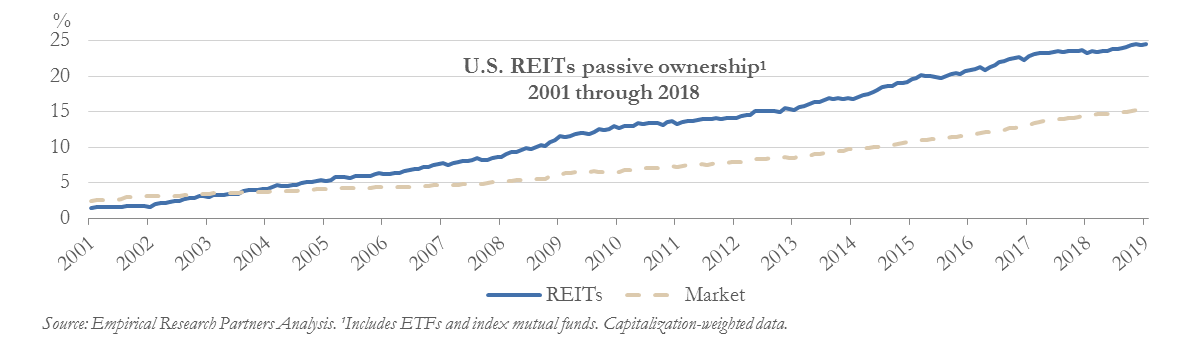

While investable index funds first sprouted in the early 1970s, only recently has passive management taken a more prominent role – net inflows into U.S. actively managed funds, for all asset classes and including exchange-traded funds (ETFs), has been negative since 2006 while passive share has increased steadily since the early 1990s. Morningstar research shows $4.2 trillion of cumulative net flows to passive strategies between 1995 through 2017, and only $2.4 trillion to active funds during this time; a record $663 billion flowed into passive strategies in 2017 alone. Trends persisted into 2018, with nearly $485 billion of passive inflows versus roughly $300 billion of active outflows for the year. Passive share of the estimated $17 trillion U.S. assets under management is estimated at nearly 39%, including 14% for U.S. stocks, up from less than 2% in the mid-1990s. Ironically, there are more market index funds and ETFs than underlying publicly-traded U.S. securities!

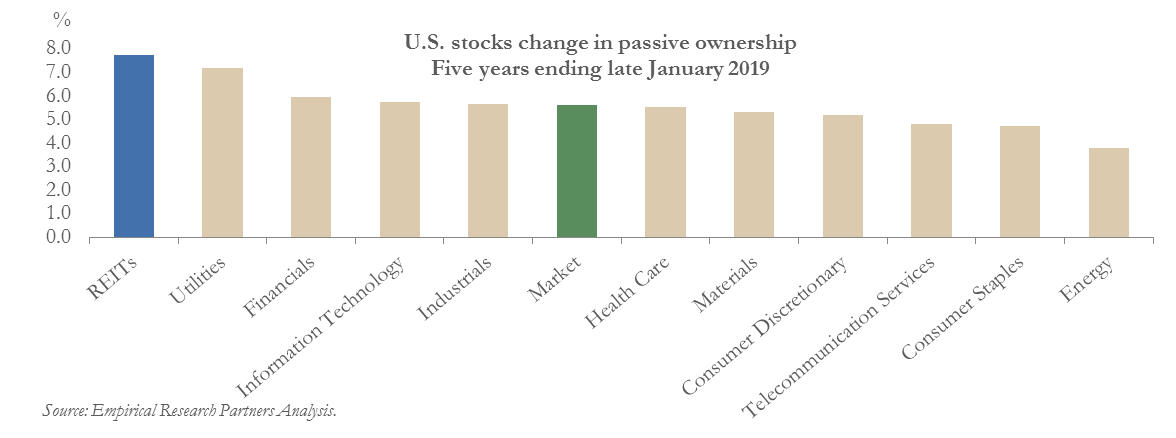

Certainly “passive” and “indexed” are not always interchangeable, as “active” strategies may lurk under the hood of “indexed” investments. Nevertheless, it is notable that REITs are the most passively-owned equities among the 11 S&P Global Industry Classification Standards (GICS). This REIT “passive-ownership spread” compared to other equities began in mid-2003 and has been steadily rising ever since. A recent Bloomberg article showed 8 of the top-10 passively-owned U.S. equities are REITs, and nearly all are smaller capitalization retail REITs – including Tanger Factory Outlets (46.9% passive ownership), Washington Prime Group (39.2%), RPT Realty (38.2%), Pennsylvania REIT (37.9%), CBL & Associates (37.7%), Kite Realty Group (37.3%) and Urstadt Biddle Properties (37.0%).

As an active REIT manager with a long-term track record of outperformance, a key question comes to mind: Why are REITs the Rodney Dangerfield of all S&P GICS, given high passive ownership as well as generalist investors’ persistent underweight to the group? Indeed, REITs are arguably the most inefficient of all asset classes given the meaningfully larger private/direct commercial real estate market where transactions can shed light on appropriate public market share prices (price discovery!) – the market capitalization of U.S. equity REITs totals ~$1 trillion, or an estimated 15% of all U.S. commercial real estate. REITs are the tail of the commercial real estate dog, inseparable over the long term with share prices tethered to net asset value (NAV), as determined by private market transactions, as the value of, say, an office building should not differ solely based on where the rent is sent.

Notably, REITs can create value by arbitraging unwarranted disconnects between public and private market pricing – issuing common equity when REITs trade at a premium to private-market-based NAV, and conversely repurchasing shares and/or selling properties or the entire company when discounts persist. This dual/comparable valuation track is unique to REITs, affording active managers who possess long-standing relationships with senior management, strong underpinnings in commercial real estate fundamentals and countless property visits under their belts the ability to outperform passive investors over longer horizons.

REITs also require different valuation methodologies and speak a different language than the generalist investment community (e.g., NAV, Funds From Operation, Adjusted Funds From Operations, implied cap rates, nominal cap rates, economic cap rates, etc.), likely leading to the persistent under-weight outside of the dedicated REIT investment community given the specialized skill set needed. This further suggests the (active but really) passive ownership – and, hence, inefficiency/ability to outperform – is even larger than perceived if solely relying on index and ETF ownership data. While REITs exited puberty in August 2016 by getting its own S&P GICS, the newest industry classification since 1999, it arguably and unintentionally made REITs easier to index and even more attractive to “active-but-passive” and “passive-passive” monies since then.

Another question on our minds: Why is retail the most passively owned of all REIT sectors? Passive management often leads to herd investing, with the “winners” growing market capitalizations leading to even greater passive demand in a rising market, since weighting securities by market capitalization is the most common passive construction methodology – a common criticism of the passive/buy-hold strategy. Rather, these aforementioned retail REITs have generally underperformed their retail peers, REITs overall and the broader equity markets over long horizons with shrinking market capitalizations that would otherwise relegate them to the bottom of the passive ownership charts; though as share prices fall, dividend yields rise which might make some suitable for dividend-oriented index funds, smaller capitalization indices or other specialized benchmarks. For example, the S&P High Yield Dividend Aristocrats index is effectively weighted by dividend yield, which presumably desires “dividend growers” but perversely also enhances demand for underperformers. Importantly, many retail REITs are undesired and under-owned by active managers for a reason (really several reasons, including negative operating trends, high leverage, dilutive dispositions, etc.) leading to lower-active / higher-passive ownership – retail has been undergoing secular shifts over the past few years given the unrelenting rise/threat of e-commerce, which has weighed more heavily on fundamentals and share prices, and more heavily on passive REIT portfolios too.

Our final question: Is high / rising passive REIT ownership a positive development for active investment managers? Said differently – Should I have become a doctor like my parents wanted? Sigh. While high passive ownership can create liquidity and governance challenges, and also magnify volatility, we believe the answer is “YES”…to the former question. The EMH leads with the presumption that markets are “efficient”, and conversely inefficient implies an ability to find temporarily mispriced equities, opining on companies whose share price does not reflect current values to buy “cheap” and sell/avoid “expensive” securities. To the extent the high / rising passive share in REITs remains agnostic to profitability, operating fundamentals, share prices, relative valuation, cash flow growth, management prowess / experience, capital allocation, portfolio quality, internal / external growth opportunities, strategic shifts, balance sheet strength, equity / debt capital markets and the like, active investment managers should continue to uncover opportunities to outperform over the longer term in an already-inefficient REIT market.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.