Image used with permission of Philadelphia Inquirer Copyright© 2018. All rights reserved.

Amazon, Inc. sent hundreds of municipalities into frenzy in September 2017 when the e-commerce juggernaut announced plans to establish a second corporate headquarters in North America, uninspiringly dubbed HQ2. Nearly 250 cities responded to Amazon’s Request for Proposal (RFP), with hopes of adding 50,000 full-time, highly-paid Amazons (Amazonians?) to its tax coffers within 15 years, in addition to $5 billion of promised capital expenditures over a similar time period. HQ2 is also expected to have a halo effect, with the “winner” validated by one of the largest, most successful and fastest growing companies on earth – other employers and employees will desire a nearby presence, boosting economic growth even more. Effectively a multiplier effect expected to create a new ecosystem of tech talent, similar to Seattle where Amazon followed Microsoft and is now the dominant employer, with Apple, Facebook, Google and others similarly drawn to the area in recent years.

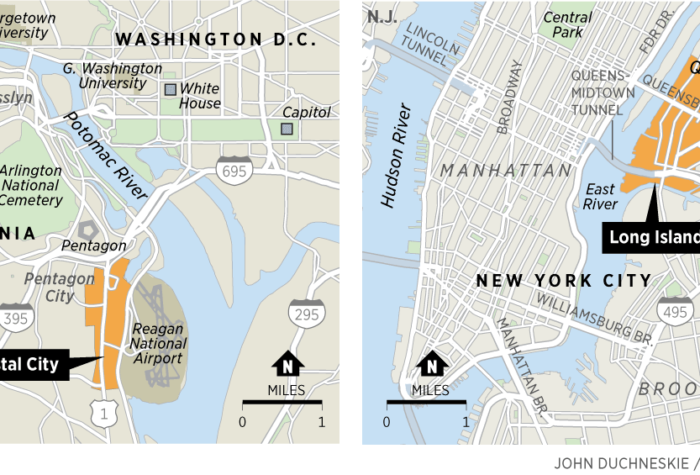

Amazon quickly whittled its RFP hopefuls to 20 finalists by the beginning of this year, yet took several more months to evaluate (negotiate?) tax incentives offered to the company. Amazon ultimately decided to split its baby in half, recently naming Northern Virginia’s National Landing (f.k.a. Crystal City, including the surrounding Pentagon City and Potomac Yards) and the Long Island City (LIC) neighborhood of Queens (adjacent to and east of Manhattan) the “winners”…huzzah! Also on the podium is Nashville, Tennessee with 5,000 to-be-hired employees responsible for customer fulfillment, transportation, supply chain and similar activities…meh.

Amazon’s HQ2 decision presumably boiled down to a few factors, including: (1) access to a deep pool of talent and the ability to recruit new employees, particularly in light of the current tight labor market, (2) communities large enough to absorb Amazon’s presence and growth, following lessons learned from the dramatic transformation of Seattle where an estimated 1 in 12 workers wears the Amazon badge, and (3) proximity to Washington DC, given a desire to improve relations with the federal government, a large client for Amazon Web Services but ostensibly to monitor (influence?) increasing regulation on large tech companies with outsized impact on people, industries and elections.

Yet given the significant state and local incentives each city offered up to attract Amazon, it begs the question whether these regions will end up “winners” or become prominent case studies for the “winner’s curse” – wherein “winners” tend to overpay or the value of the prize is worth less than anticipated. New York’s performance-based incentive package is a whopping $3 billion while Virginia’s carrot was slightly less at $2.5 billion, with the expectation that new jobs, additional capital investment and incremental tax revenues will more than offset the cost of the direct financial incentives. Interestingly, Google recently announced plans to double its 7,000 person workforce in New York City within 10 years with plans to develop a $1 billion new campus along the Hudson River while Apple unveiled a similarly-sized $1 billion expansion in Austin Texas to eventually add 5,000 new workers to its existing 6,200 headcount in the city – both with less fanfare and fewer/negligible incentives to deepen their roots.

Less arguable in this debate…Amazon is the clear winner in the HQ2 dog & pony show, having coaxed significant tax incentives from cities that were likely in the crosshairs of CEO Jeff Bezos and company long before the search process even began; Bezos’ 2nd and 3rd homes are not coincidentally a short distance from the two winning headquarters. In addition, neither municipality seemingly reduced the tax incentives following Amazon’s decision to bait with one location and switch to two headquarter as it neared the finish line.

Also inarguable winners…commercial real estate and several REITS! The office market in Northern Virginia / National Landing has suffered for years following the slow erosion of its former tenant base, which included defense-related government agencies and contractors. The most dominant office landlord in the area is JBG Smith (JBGS), a REIT that had been developing a “place making” strategy for Crystal City to attract more private sector tenants. Amazon will accelerate the revitalization process, with plans to initially lease 500,000 square feet from JBGS and purchase land parcels entitled for up to 4.1 million square feet of development. Amazon will also engage JBGS as its development partner, property manager and retail leasing agent for the development of these parcels over time.

Amazon’s presence should also be a long-term positive for the residential market in the surrounding area. The Washington DC region has faced significant new apartment construction of late that has kept a lid on rent growth. Apartment owners, including Equity Residential and Avalon Bay which have investment in both named cities, are surely celebrating the arrival of at least 25,000 new employees over time which should create added demand for their units. Owners of retail properties are also expected to benefit from enhanced spending in the region – Kimco Realty, Regency Centers, Simon Property Group and several others have investments near the newly announced Amazon headquarters.

Amazon’s future Long Island City campus has a light industrial/manufacturing past that has been transitioning into office and residential over the past decade. Amazon’s move here resembles its initial commitment to build its initial 11-building campus in the South Lake Union area of Seattle over a decade ago, with expectations that LIC can be similarly improved. Amazon is negotiating to acquire a combination of public and private land parcels to eventually develop a 4 million square campus along the East River waterfront – unlikely to make an immediate dent in the ~20% office vacancy in this submarket, but should benefit owners of nearby office, residential and retail properties longer term.

The debate surrounding unnecessary or outsized tax incentives aside, HQ2 and HQ3 (or is it HQ 2½?) should be an economic boon to National Landing, Long Island City and nearby communities, similar to Amazon’s long-term positive economic impact on Seattle. Local real estate markets always benefit from employers and employees establishing a presence, particularly of the scale that is planned for both HQ2 locations, given new demand for office space, residential units, retail centers and the like…a timely reminder that commercial real estate and REITs house the overall economy, with benefits accruing irrespective of the trajectory of interest rates, over decades rather than on a quarterly or annual basis.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.