After nearly five months of behind-the-scenes negotiations, regional mall REIT GGP Inc. (GGP, formerly known as General Growth Properties) recently agreed to be acquired by its largest shareholder (34% owner, originated from its role as plan sponsor and cornerstone investor during GGP’s bankruptcy reorganization and recapitalization in 2010, including the receipt of 57.5 million warrants with an exercise price of $10.75/share for its $2.3 billion investment) Brookfield Property Partners (BPY) at a price that underwhelmed the investment community; the regional mall REIT sector declined 2.6% on the day of this news, with GGP falling even more at 5.3%.

Source: FactSet.

While the updated “headline” offer of $23.50/share in cash is slightly higher than the initial $23.00/share cash or BPY unit offer from November 11, 2017, the current proposal places a cap on the aggregate cash consideration at $9.25 billion such that all GGP shareholders will likely end up receiving a pro-ration of 61% cash and 39% BPY units or newly created BPY U.S. REIT (BPR, a tracking stock for BPY). As such, the updated offer for GGP based on Brookfield’s recent (yet now 15% lower) share price was closer to $22.00/share…a slight premium to GGP’s prior day’s closing price but still well below most investor’s view of net asset value (NAV), a theoretical liquidation value that should apply here but was seemingly ignored by GGP’s Special Committee whose members voted unanimously in favor of the Brookfield offer; consensus NAV for GGP is currently over $27/share.

“We are reviewing all strategic alternatives to bridge the [NAV] gap” – GGP CEO Sandeep Mathrani, May 1, 2017

Yet Brookfield is in a unique position as GGP’s largest shareholder, which significantly reduces the chances of a competing and potentially higher (arguably closer to private market) bid finding success. Without Brookfield’s existing stake, a more robust bidding process for GGP’s irreplaceable assets (entire portfolio or by property) would have been possible and likely led to more attractive pricing for its shareholders. Rather, GGP’s Special Committee was faced with few appealing choices: (1) continue to let the stock languish below NAV given the negative secular trends facing bricks & mortar retail real estate, (2) accept Brookfield’s revised bid at a price above the current share price but still below NAV, yet with the opportunity for investors to diversify into BPY, a larger and more globally diversified owner of commercial real estate, or (3) reject the acquisition offer from the only logical buyer and watch the stock decline even more as its M&A premium evaporates, potentially compelling Brookfield to exit its entire GGP stake which would weigh on shares even more. Recall GGP’s CEO effectively put the REIT “in play” during its first quarter 2017 earnings call in May 2017 when he indicated “We are reviewing all strategic alternatives to bridge the [NAV] gap” only to conclude in August 2017 that they will “stay the course and continue doing what we’re doing”, pushing GGP’s share price even lower and likely compelling Brookfield to step in with a formal offer to acquire the entire company a few months later.

“We believe that at this time that the highest and best use of our time and effort is to stay the course and continue doing what we’re doing” – GGP CEO Sandeep Mathrani, August 2, 2017

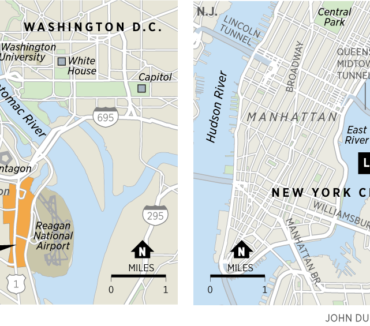

Given these unusual circumstances, we believe pan-European mall owner Unibail-Rodamco’s deal to acquire Australia-listed Westfield Corp. (predominately U.S. and U.K. malls), announced in December 2017 and expected to close in the coming months, is more reflective of U.S. regional mall “comps” than the Brookfield-GGP transaction. The arms-length Unibail-Westfield offer translates into a roughly 5% implied cap rate for its U.S. malls only, which compares to the mid- to upper-5% implied cap rate for the Brookfield-GGP deal; Westfield and GGP’s U.S. mall portfolios are comparable as both generate tenant sales productivity of about $600 per square foot. Admittedly, there have been very few Class A mall transactions given the past decade of consolidation within the industry, and Brookfield’s offer still needs to be approved by a majority of GGP’s non-Brookfield shareholders…which the market seems to believe is in doubt as GGP shares continue to trade below the value implied by the Brookfield bid. Yet these portfolio transactions need to be carefully considered when deriving current values for the U.S. mall REITs. The last few high-quality mall sales occurred in 2016, all domestic buyers and notably Quaker Bridge Mall (New Jersey) at a 4.2% cap rate in February 2016 which is most similar to GGP’s regional mall portfolio given tenant sales of roughly $640 per square foot; also tourist-heavy and more highly sales productive Las Vegas properties including The Shops at Crystals at a roughly 4.2% cap rate (April) followed by a 50% interest in Fashion Show at a 3.7% cap rate (August) and Miracle Mile Shops at 4.7% cap rate (October).

Indeed, we believe private market comps for high quality U.S. regional malls would continue to transact at-or-below a 5% cap rate, despite the negative narrative surrounding physical retail real estate as the highest quality properties should continue to garner a disproportionate share of retailers and e-tailers desiring a physical store front…a view which may be tested as Brookfield, assuming its bid is successful, will likely attempt to sell select GGP malls to reduce the significant debt necessary to complete this transaction.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.