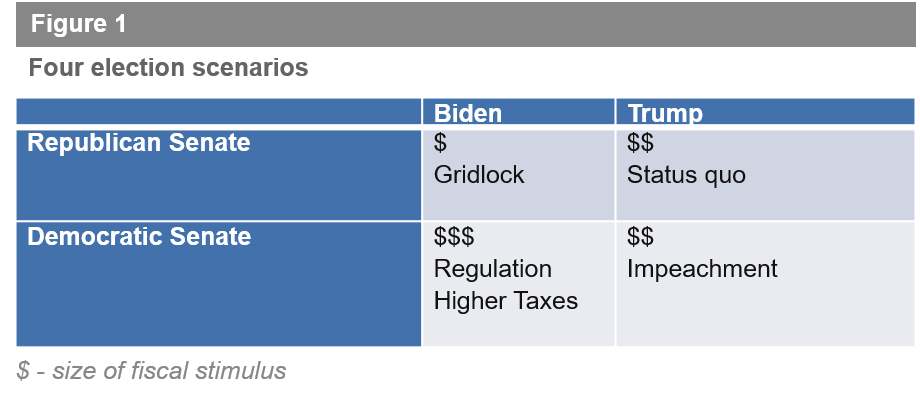

As we await recounts in some of the close battle ground states and the inevitable lawsuits to follow (did anyone expect this annus horribilis to end differently?), we wanted to take a break from constantly refreshing websites for updated vote counts to offer quick thoughts on the election and its impact on REITs for the months ahead. While the race for control of the Senate and the White house is tight, the most likely outcome seems to be the Democrats taking control of the Executive branch by a narrow margin and the Republicans retaining control of the Senate with only one seat flipped, hardly the “blue wave” envisioned by a number of prognosticators.

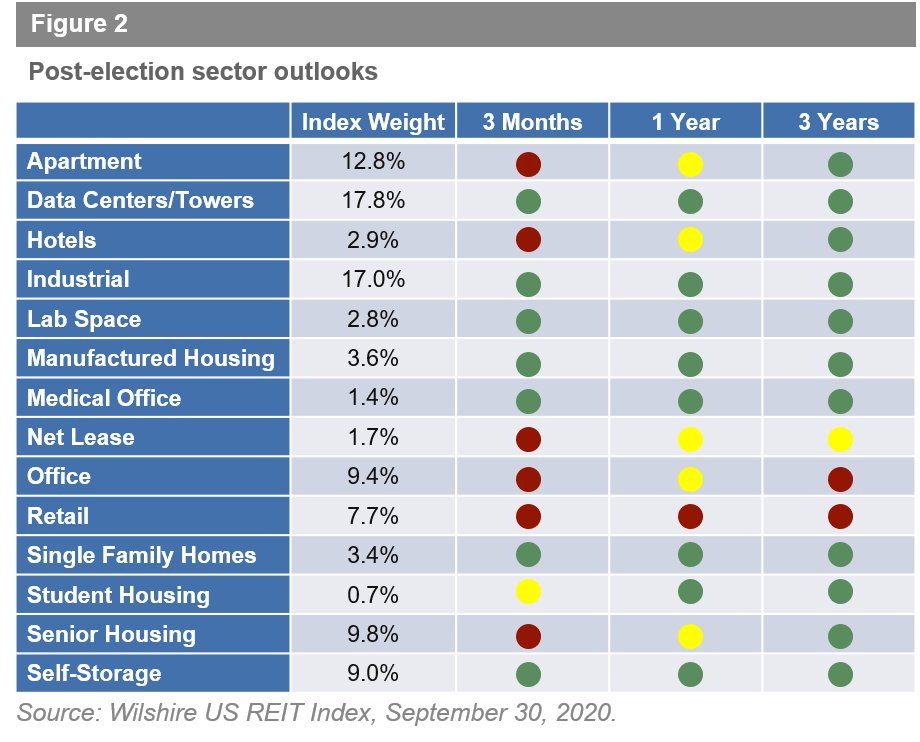

In the short term (the next three months), this presents the daunting prospects of a lame-duck president and a purse pinching Senate presiding over a nation that is seeing coincident indicators of an economic recovery falter (Wednesday morning, private payroll showed gains of only 364k vs. 600k expected) as well as rising case counts and hospitalization (albeit a lower trajectory of morbidity) – definitely a negative for the economy in general and cyclical and value stocks/REITs specifically: retail/lodging the worst, apartment/office a bit less bad; the winners will be the usual suspects: data centers, towers, industrial, manufactured housing, single family homes for rent, and self-storage.

In the longer term (after the inauguration), the picture brightens; while the size of the eventual fiscal stimulus will most likely be smaller than under a “blue wave” scenario, gridlock in Washington could also curb the regulatory/taxation impulses of the progressive agenda. If a viable vaccine can be developed and widely distributed, the burden social distancing has imposed on the economy will likely be lifted (think CBD office, senior housing, and lodging). While the upcoming winter promises to be difficult, we can look forward to some positive developments in the spring. Hopefully, this too shall pass; meanwhile, the REIT market is open for investors offering liquidity and price discovery.

Disclosure

Adelante Capital Management, LLC (“Adelante”) is a registered investment adviser with the SEC. This report is for informational and professional purposes only, cannot be distributed without express written consent, and does not constitute advice, an offer to sell, or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The contents of this report should not be relied upon in making investment decisions. The information and statistical data contained herein have been obtained from sources that we believe to be reliable but in no way are warranted by us as to accuracy or completeness. The accompanying performance statistics are based upon historical performance and are not indicative of future performance. The types of investments discussed do not represent all the securities purchased, sold, or recommended for clients. You should not assume that investments in the securities or strategies identified and discussed were or will be profitable. While many of the thoughts expressed in this report are stated in a factual manner, the discussion reflects only Adelante’s beliefs about the financial markets in which it invests portfolio assets. The descriptions herein are in summary form, are incomplete and do not include all the information necessary to evaluate an investment in any investment or strategy.