Welcome to

Adelante Capital Management

Founded in 1995, Adelante is a minority-owned investment management firm focused on publicly traded real estate securities, predominantly REITs. We employ a disciplined investment process seeking high quality portfolios for our clients at attractive prices relative to direct real estate values or Net Asset Value (“NAV”). Learn more about our firm

Institutional Investors

Adelante’s legacy as a premier real estate securities investment firm is a reflection of our long-term relationships with institutional investors and the financial investment consultants that serve and represent our clients, as well as companies in the commercial real estate investment community.

Financial Professionals

The inclusion of real estate securities in an investment portfolio and access to quality real estate investment expertise is no longer the sole realm of the institutional investor. Through their financial advisors, individual investors can access Adelante’s deep investment knowledge and experience.

Insights

Learn from our library of articles showcasing our industry expertise

The Road Ahead for REITs

I see REIT Passive Ownership Rising… Is Trouble on the Way?

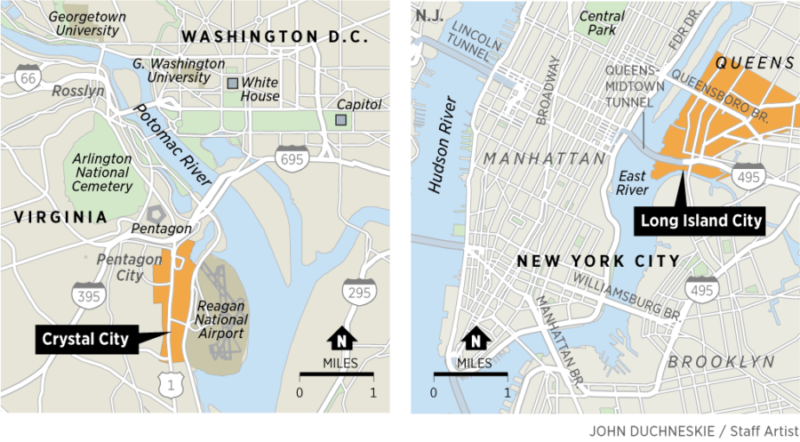

And The Winner is… Amazon! & REITs!

Take Out or Fake Out? Brookfield’s Offer for GGP Underwhelms, For a Reason

Michael TorresWe honor the privilege entrusted in us by each and every client.

Jeung HyunOur size allows us to apply our NAV metric in the most disciplined manner possible.

Friday Market Recap

Weekly Assessment of Global Real Estate Trends

SL Green Realty

Rexford Industrial Realty, Inc. (REXR)

Apartment Investment and Management Company (AIV)

Domestic Real Estate Securities Strategy

Global Real Estate Securities Strategy

Adelante’s Global Real Estate Investment Strategy is designed for those private and institutional and individual investors who both recognize the diversification benefits of real estate in their overall investment portfolios and also desire exposure outside the U.S. commercial real estate market.