Friday Market Recap

Weekly Assessment of Global Real Estate Trends

SL Green Realty

North America In the U.S.: Coronavirus trends continued to strengthen this week with US cases down nearly 80% over the last six weeks. Bloomberg noted that the number of vaccine doses delivered in the US should rise from the current pace of 10-15M a week to nearly 20M a week in March, more than 25M a week in April

Rexford Industrial Realty, Inc. (REXR)

ASIA In China: Most major product groups grew, except for mobile handsets and textiles, further solidifying China’s robust recovery from COVID. In Japan: The government raised its alert for the strain on the medical system to the highest of four levels and experts warned of serious consequences if the current trends did not reverse course soon. REIT Focus: Keppel

Apartment Investment and Management Company (AIV)

ASIA In China: The move further strains the economic relationship between both countries. In addition, the outlook of the Biden administration quickly reestablishing the status quo before the Trump administration took over, was dealt a blow this week when the New York Times reported that Biden would not remove the 25% tariffs on goods immediately. US President Elect Biden

Featured Global Market Reports

Browse finance headlines from around the globe we’re keeping an eye on

Mexico: The Rise of Fibra

We conducted three days of due diligence on the nascent REIT industry in Mexico (two days in Mexico City and one in Monterrey), our itinerary filled with back-to-back meeting with management teams of five of the seven exiting Mexican REITs, called Fideicomisos de Infrastructura y Bienes Raices or Fibras for short. Our discoveries: Mexico is experiencing a manufacturing renaissance.

A Greek Tragedy…or is it a Comedy?

A Greek Tragedy… or is it a Comedy? Clearly, it is a little of both. As the new Greek government fails to form a coalition, the entire “progress” of the Troika’s (IMF/ECB/EC – and Germany) negotiations reverts back to uncertainty and talk of a Greek exit from the Euro. It is comical that Greece can hold the entire Eurozone

UK CEO Panel Talks London Market

Our European analyst recently attended the BAML UK Real Estate conference in London. One of the panel discussions involved five CEOs of prominent UK REITs talking about the state of the London real estate market. The panelists were John Burns (DerwentLondon), Chris Grigg (BritishLand), David Atkins (Hammerson), David Fischel (Capital Shopping Centers), and now retired Francis Salway (Land Securities).

Domestic & Capital Market Insights

What’s happening at home, outlooks & reviews

The Road Ahead for REITs

As we await recounts in some of the close battle ground states and the inevitable lawsuits to follow (did anyone expect this annus horribilis to end differently?), we wanted to take a break from constantly refreshing websites for updated vote counts to offer quick thoughts on the election and its impact on REITs for the months ahead. While the

I see REIT Passive Ownership Rising… Is Trouble on the Way?

The efficient-market hypothesis (EMH) is a long-debated economic theory first introduced in nascent terms in the early 1900s, and advanced starting in the 1950s, which essentially suggests “security prices fully reflect all available information.” Although variations exist, the natural conclusion is that stock price movements are unpredictable; therefore “you cannot beat the market” and active portfolio management is a

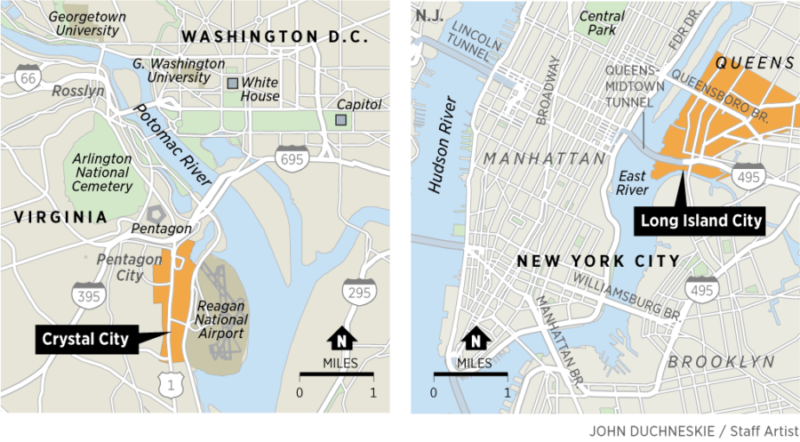

And The Winner is… Amazon! & REITs!

Image used with permission of Philadelphia Inquirer Copyright© 2018. All rights reserved. Amazon, Inc. sent hundreds of municipalities into frenzy in September 2017 when the e-commerce juggernaut announced plans to establish a second corporate headquarters in North America, uninspiringly dubbed HQ2. Nearly 250 cities responded to Amazon’s Request for Proposal (RFP), with hopes of adding 50,000 full-time, highly-paid Amazons

Take Out or Fake Out? Brookfield’s Offer for GGP Underwhelms, For a Reason

After nearly five months of behind-the-scenes negotiations, regional mall REIT GGP Inc. (GGP, formerly known as General Growth Properties) recently agreed to be acquired by its largest shareholder (34% owner, originated from its role as plan sponsor and cornerstone investor during GGP’s bankruptcy reorganization and recapitalization in 2010, including the receipt of 57.5 million warrants with an exercise price