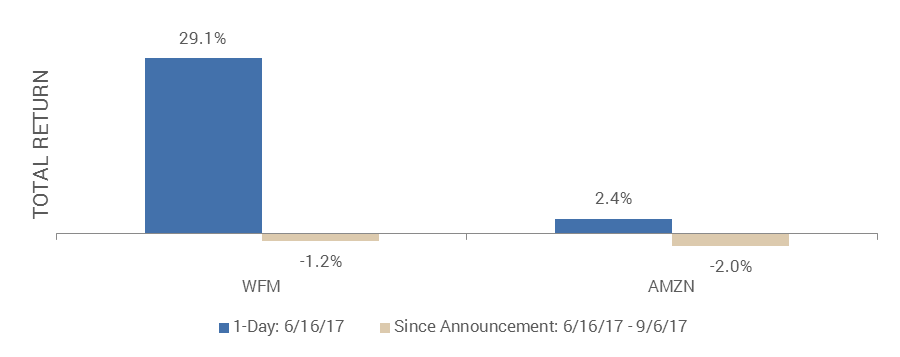

Amazon’s (AMZN) announcement on the morning of June 16, 2017 that it had entered into an agreement to acquire Whole Foods Market (WFM) for $42 per share in an all-cash transaction valued at $13.7 billion was positively received by shareholders of both companies. WFM shares ended the day up 29.1% (above the acquisition price in anticipation of a competing/higher offer) with AMZN shares closing 2.4% higher as the market cheered the e-commerce giant’s aggressive and decisive action. Remarkably, Amazon’s market capitalization increased by over $11 billion on the announcement, nearly as much as the entire price tag for Whole Foods Market whose acquisition boosted AMZN shares in the first place! Share prices have retreated a bit since then, with WFM having closed at the $42 per share offer price when the deal closed on August 28 and AMZN’s performance driven more by its recent second quarter earnings rather than anything related to its acquisition of Whole Foods Market.

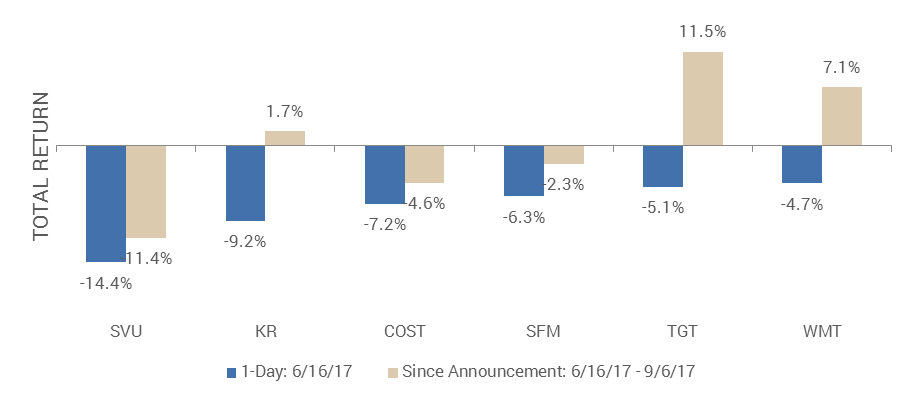

At the same time, share prices of the food retailers expected to be most negatively impacted by the Amazon-Whole Foods Market combination unsurprisingly declined when the merger was announced, as Amazon has a tendency to lower retail prices and margins in its quest for growth…which proved true as Amazon reduced prices on its best-selling items once the merger closed, with more discounts to come. Share prices of the publicly-traded supermarket chains, including Supervalu (SVU) and Kroger (KR) as well as Whole Foods knockoff Sprouts Farmers Market (SFM), remain well below their pre-announcement prices given this intensifying competition. The recent/post-announcement performance for Target (TGT) and Wal-Mart (WMT) have been better, likely attributable to greater product diversification (selling non-perishable items) as well as their own investment and inroads into growing their e-commerce platforms.

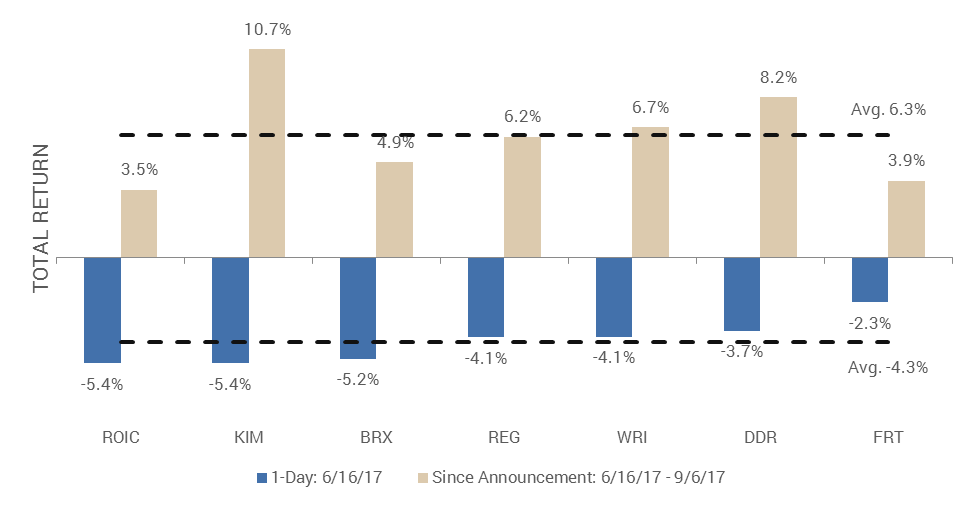

A bit more surprising were the retail REITs who were cast in a similarly negative light based on the market’s view that Amazon would reduce prices and profitability for all grocers in the U.S., an industry notorious for already-skinny margins, thereby governing rent growth and possibly pushing less-efficient stores and operators to extinction. The FTSE NAREIT Equity Shopping Centers index fell 3.9% on the day of the announcement, despite the sector already trading at one of the largest discounts to private market values. The seven largest shopping center REITs with property portfolios predominantly anchored by traditional grocers and/or power centers that also have grocery sales fared even worse with share prices down an average 4.3% on this news.

Our view at the time was more sanguine than what the share price declines were implying for the new-and-presumably deteriorating outlook for the shopping center REITs; see our June 22, 2017 note Amazon’s $13.7 Billion Step into Bricks & Mortar. We again note that Amazon acquired Whole Foods Market’s leasehold interest across 460+ storefronts rather than ownership of the underlying real estate, limiting their ability to potentially close stores and, more likely, suggesting the e-tailer would continue to be a premium rent-paying tenant rather than a competing owner-operator of retail real estate. We continue to believe Amazon intends to own/operate significantly more than the 460+ Whole Foods locations over time, possibly through another acquisition yet more likely the bricks-and-mortar newbie will open significantly more stores and will seek trusted real estate owners/partners at the most-desired locations, which should ultimately benefit the highest-quality retail centers, specifically the retail REITs who collectively own the best assets in the highly fragmented, often passively managed, shopping center industry.

It is still too early to know how the Amazon/Whole Foods Market combination will evolve; Amazon’s earnings conference call on July 27 indicated they “believe there’ll be no one solution [as it relates to their grocery strategy], so [they’re] experimenting with a number of the formats from physical pickup points…to online ordering and delivery to your door.” For now, the market appears to be catching up with our more-positive/less-negative outlook as the shopping center REITs are up an average 6.3% since their mid-June swoon, with most retail property owners more than recovering their steep and puzzling Amazon-induced one-day share price declines.

The shopping center REITs were similarly positive on the Amazon-Whole Foods combination during the recent second quarter earnings conference calls, essentially affirming the value of physical locations as retailers and e-tailers continue to step into each other’s selling playgrounds. Following are select comments from shopping center REITs with property portfolios that are predominantly anchored by traditional grocers and/or power centers that also have grocery sales.

- “I think it is fair to say that the debate surrounding the death of physical retail is over. The Amazon Whole Foods transaction…point[s] to a vibrant albeit different looking retail real estate world. In this new world order, omni-channel is the new normal, and that is where the retail battles will take place. Those that embrace and master the omni-channel approach that combine technology, social media and physical real estate will thrive. Those that ignore will do so at their own peril. Omni-channel is a win-win for the retail sector. For the consumer, it provides convenience, lower prices and optionality. For the retailer, it provides opportunity to reach more customers, generate add-on sales upon pickup, reduce shipping costs and limit the number of returns. Physical retail has a large role to play in this effort: to bring the best shopping experience to the customer, especially as retailers continue to explore different ways to overcome the last-mile challenge. I see [Whole Foods] as a natural fit for [Amazon] as they continue to expand into physical retail. They’ve done it with the book store, now they’re doing it with the grocery store.” – Kimco Realty Corp. (KIM) on July 27, 2017.

- “Experts resoundingly believe that the [Amazon-Whole Foods] transaction confirms the importance of bricks-and-mortar stores to future omnichannel retailing. One of the big questions is whether or not Amazon will seek to modify the Whole Foods concept with the goal of competing directly with these grocers. Mind you, in an industry that is well known for its razor-thin margins, no doubt it will take time to play out. That said, from all our discussions that we’ve had with our grocery tenants, we can assure you that they are not sitting on their hands waiting to see what happens. They all have been testing various omni-channel strategies for the past several years, and it’s safe to say that they are now accelerating their efforts. One of the most challenging aspects of executing a profitable grocery e-commerce strategy is figuring out how to solve the so-called last mile delivery conundrum. Industry experts believe that one of the keys to success in solving this challenge is having stores in the right markets and in the right strategic locations within those markets. We believe our portfolio is well situated in that regard.” – Retail Opportunity Investments Corp. on July 27, 2017.

- “The recent announcement that Amazon is purchasing Whole Foods is…confirmation that brick-and-mortar stores are an essential component of the omnichannel model of the future. Good retail real estate still has good value. While the Amazon, Whole Foods deal will drive change in the grocery sector, we believe that it will be a positive for our real estate long term. Our supermarket operators will adapt and evolve as well, and we will assist them with our great locations.” – Weingarten Realty Investors (WRI) on July 28, 2017.

- “We look at the landscape of new competitive entrants…Amazon and Whole Foods…we would expect would grow that platform. We’re actually encouraged by what we see as a lot of capital being invested in a physical store. But I think the Amazon transaction…highlighted the importance of a physical platform in that business, not just the bricks and mortar, but the business of delivering that assortment of goods, and prepared foods, and everything to the customer at a reasonable price.” – Brixmor Property Group (BRX) on August 1, 2017.

- “Amazon’s announced purchase of Whole Foods reinforces our conviction that a well-located bricks-and-mortar presence that is convenient to the customer is a critical component for the success of any omni-channel platform. [Amazon’s] paying over $40 million a store, so we don’t expect them to do anything that would impair this wonderful brand that Whole Foods has, so we don’t expect it to be converted to 40,000 square foot warehouse, but I’m sure they’re going to use some of the store for pickup, delivery et cetera from an Amazon standpoint. I think it reinforces our conviction about the importance of retailers being able to conveniently service their customers through bricks-and-mortar. It is and it remains the most efficient way to deliver the last mile.” – Regency Centers (REG) on August 4, 2017.

The views expressed in this update are as of the date of this blog entry. These views and any portfolio holdings discussed in the update are subject to change at any time based on market or other conditions. The adviser disclaims any duty to update these views, which may not be relied upon as investment advice. In addition, references to specific companies’ securities should not be regarded as investment recommendations or indicative of the Adelante products, strategies, or portfolios.